Mortgage Calculator Formula

Mortgage Calculator Formula

{mortgager}

This package was developed to calculate homeownership costs for MassHousing’s Commonwealth Builder Program. This package was used to analyse a proprietary dataset of home sale records from 2010 to 2020 in Massachusetts to determine the affordability of existing and historic sales.

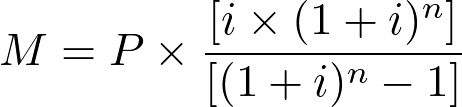

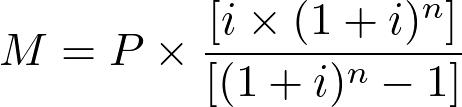

Formula

The formula used for calculating monthly home-ownership payment amounts is based on a widely accepted monthly mortgage formula, which here is adapted from that seen on the Nerdwallet website.

Where:

- M = Monthly mortgage amount

- P = Principal amount, ie total loan amount

- i = Monthly mortgage interest rate

- n = Number of payments across loan duration. (This is generally assumed to be number of months. For example, a loan with a payback period of 30 years, will have 360 payments in total)

In addition to the monthly mortgage payment, there are other costs associated with home-ownership which are then added to calculate total home-ownership costs, namely:

- PMI factor – only for loans with a downpayment less than 20%, assumed at 7.5% annually on the mortgage amount

- Home-owners insurance – assumed at $1000 annually

- Condo fees – applicable only to condominium sales, assumed at $1000 annually

- Property Tax - an annual percentage amount taxed on assessed property value dependent on the jurisdiction the unit is located in.

Installation

You can install the released version of mortgager with:

devtools::install_github("aseemdeodhar/mortgager"){mortgager}

Load the package with this line:

library(mortgager)Examples for each function:

mortgager::monthlypayment()

calculates monthly home-ownership costs based on tax rates, interest rates, downpayment rate, and home cost price.

monthlypayment(mortgage_rate = 3,

property_tax = 12,

downpayment_rate = .2,

home_price = 450000)## [1] 2051.108mortgager::max_homeprice()

calculates maximum affordable home price based on annual income with a set monthly housing cost percentage (default is 30%).

max_homeprice(annualinc = c(61000, 75000, 22330, 120000),

mortgage_rate = 2.7,

property_tax = 6)## # A tibble: 4 x 4

## income_level atincome at80pc at120pc

## <dbl> <dbl> <dbl> <dbl>

## 1 61000 224144. 179316. 268973.

## 2 75000 278561. 222849. 334273.

## 3 22330 73838. 59070. 88606.

## 4 120000 453471. 362777. 544166.mortgager::downpayment_amt()

calculates the total downpayment amount based on sale price and downpayment rate

downpayment_amt(home_price = 250000,

downpayment_rate = 0.10)## [1] 25000mortgager::reqd_income()

calculates the minimum annual income required for total housing costs to remain at or below a set proportion of household income.

reqd_income(monthlypayment = 2000,

housing_cost_rate = 0.30)## [1] 80000